India’s infrastructure requirements – an eye-opening reminder of the world’s staggering demand for all energy sources

I’ve recently succumbed to an infatuation, much like a grade-school crush. Mind you, what is appealing at my current age is markedly different than what was back then; having traversed a generation’s worth of the realities of adulthood, and with the prospect of hoping to retire someday, the subject matter of my admiration has shifted. Monumentally.

Sadly, and weirdly, my current crush is on a company, or more specifically their stock: Brookfield Infrastructure Partners. This is disturbing in more than one way. Normally, my public admiration of a company’s stock has the effect of destroying the business as surely as if I used dynamite, however it is reasonably probable that BIP will survive even my proven ability to lethally infect that which I invest in. Furthermore, to admit that one is smitten with a business could be a sign of some sort of looming mental issue, and it might be, but check out their dividend growth history for yourself before calling me nuts.

Clues to this infatuation lie in this quote from BIP’s president in their second quarter 2019 results conference call: “…we recently secured an exclusive agreement to acquire a portfolio of 130,000 telecom towers in India … the growth in data consumption has been robust to say the least with per capita usage having increased 10-fold in the last two years alone…we have probably not seen a bigger disconnect between the organic activity level going on around our businesses and the uncertainty and weariness [that] you read about in the media.”

Several vital pieces of information spring from this quote. First is the magnitude of what’s going on around the world. BIP scours the world for suitable and profitable infrastructure investments, and the list of opportunities they catalog is staggering. The above example is a not particularly huge in their portfolio, and is one of nearly countless opportunities across a very wide spectrum. Simply reading about what they’ve purchased leads to a mind-boggling realization of the sort of infrastructure development that is going on globally. And almost none of us have a clue as to the magnitude.

Despite having at our fingertips a monumental amount of information, our general ignorance of the greater world does not seem to subside. Perhaps the sad state continues due to the very handiness of that pile of information; we don’t need to lift a finger or get off the couch or clean the food crumbs off our recumbent chests to ask our cell phones how many people are in, say, Afghanistan. We find that data point, learn nothing at all about Afghanistan beyond that, and sink right back into the inexhaustible supply of digital opinion and entertainment that we wallow in 24/7/365/84.7f/80.9m/LGBTQ+*x or A unknown.

The quote above points to the global opportunities for companies like BIP, with active operations in North, South and Central America, Europe, Asia, Australia, and I think everywhere except perhaps Togo and that little barren island off the coast of Scotland where they make curling rocks. Everywhere else is spending heavily on infrastructure.

BIP is having a phenomenal decade, buying, building and selling major blocks if infrastructure that range from toll roads to natural gas pipeline systems (including here in western Canada) to ports to data infrastructure networks. In virtually every one of these segments, business is booming in the world.

It is critically important to understand also that these expenditures as mentioned in India are not “like ours”, that is, huge expenditures we incur to optimize or refurbish or strengthen our existing standard of living. These infrastructure investments are being incurred so that billions of people can catch up to living like us. These are not wealthy societies extravagantly building frivolities like Disneyland or casinos – they’ll get to that in a few years; these projects are infrastructure required to try to keep up with the world’s demand for basic services like roads, rail networks, hospitals, and data infrastructure (if you include telecommunications as a basic service, which is arguably true). It is beside the point if governments can afford them (they can’t), but that their populations demand them.

Now consider the scale of these developments, and the almost indescribable requirement for resources. An Indian industry-tracking site pegs the country’s infrastructure requirements through 2022 at over US$770 billion in order to “have sustainable development in the country.”

And by sustainable, they are not talking renewables; they are talking about life. Renewables are part of the equation; India, like many nations, is trying its hardest to go green. Massive solar and wind initiatives are underway, as is significant spending on Green Energy Corridors. But despite pushing these initiatives as fast as possible, coal-fired power generation capacity is expected to double by 2040. There simply is no other way to keep up the pace of development than to use massive amounts of fossil fuels.

Anyone working in Canada’s petroleum sector, from production to transportation to final distribution, is at least tangentially aware of the scale of global demand for petroleum products (just as anyone living within sight of Vancouver’s growing coal export terminal is at least tangentially aware of the global demand for coal). But even with that knowledge advantage, it is hard to appreciate how much energy is required to put it all together. Once one gets a basic idea of the scale of some of these projects through, say, a not-that-embarrassing-is-it infatuation with a global infrastructure company, only then does one realize how unfathomably daunting the task is to switch away from fossil fuels.

That won’t stop the parade of energy illiterates from filling the airwaves with unrealistic/impossible renewable energy demands, or protesting a globally-insignificant pipeline like TMX, or (with the coming arrival of Extinction Rebellion in Canada) gluing themselves to buildings and annoying everyone in dubious efforts to pointlessly publicize the most widely-publicized phenomenon in decades. These activists have no plan and no clue how to fix anything, other than to mouth unworkable platitudes and impede any progress that they deem unworthy. Energy illiterates have swarmed the stage and grabbed the mic, and will fight like cornered badgers before giving it up. They will do massive damage and inflict staggering inefficiencies on our industries, because they control the media and any politician to the left of Donald Trump, and we will have to suffer through that.

It is worth noting though that the focus on emissions and climate is forcing an examination of every step of the value chain, and worthwhile optimizations are being expected. Wiser voices in the crowd are starting to turn the discussion to where it should be – on how to improve the processes related to the fuels we cannot live without, as opposed to pretending we can live without them. Countless initiatives are underway in every facet of industry to reduce emissions and shrink environmental footprints. All good news, but not enough for the terrorized act-first/think-later crowd.

We can expect over the next few years to see a few things: continued massive improvements in industrial emissions-shrinking initiatives, continued growth in demand for ever more energy (both renewable and not), continued pointless fear-based hysteria (pointless because it is focused on fighting rather than solving), and elected officials hopelessly trying to run in two directions at once by trying to pacify activists while keeping economies running. Twitter and the other social media shitholes will continue to document the madness in ever-more polarized ways; fake news will continue its ascendancy, and I will sit back and lovingly watch over my handful of BIP shares, hoping that they multiply like rabbits. That may sound crazy, but in a world that considers destroying its main fuel source and/or gluing one’s self to a building to be progressive, I’ll take the unsettling crush every time. Hollywood may not approve of the script, but it’s still less disturbing than Harvey Weinstein.

[Originally published at the BOE Report]

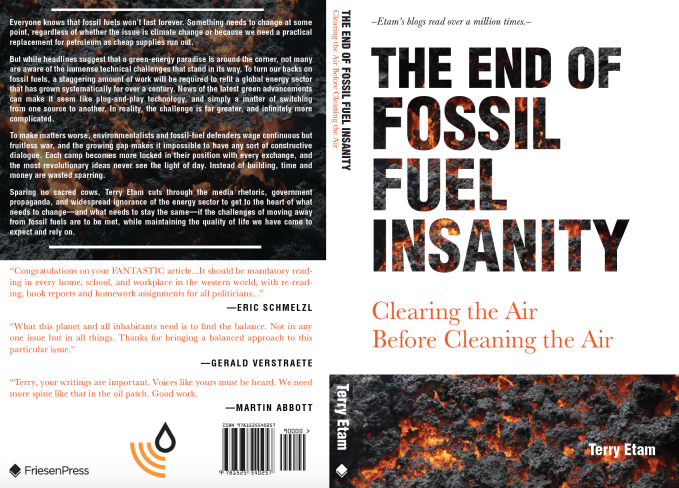

This site is financially supported by no one, except possibly you. Please consider a donation below or picking up a copy of “The End of Fossil Fuel Insanity” at Amazon.ca, Indigo.ca, or Amazon.com. It may well be the best decision you will ever make.

Donations to keep this site free of influence and of ads gratefully accepted! In any multiple of $5. Thanks!

C$5.00

7 Comments

I think it’s possible the Copenhagen Consensus group’s findings on effective climate change policies could change the conversation away from the futile and expensive efforts to immediately reduce emissions. Their only effective policy was research and development of new energy sources rated at having a benefit of $15 per dollar spent. I’ve heard carbon taxes rated at 8 cents of benefit per dollar cost and I think the highest the Copenhagen group rated anything else was at $2 benefit, so not worth the investment.

There seems to be no opposition among climate skeptics to R&D, ironically it seems like the problem is the people who actually think there’s a climate problem who have been conditioned to believe there is an emergency that requires immediate cuts to carbon emissions. But seeing your post about Micheal Moore makes me think it’s possible for some kind of sea change recognition that we cannot replace fossil fuels in the near future and even if western countries could it would make no effective difference due to growing economies.

I think there’s one other climate program that could be effective. Rather than ineffective and costly cuts to western emissions western countries could sponsor replacements to increasing coal power in growing economies. The nice thing about it is there would be a definite benefit for air quality and it would be more cost effective in terms of a potential warming problem than anything you could do in developed countries that are already relatively efficient. I assume the best thing to do would be building more natural gas and nuclear in the place of coal plants.

LikeLike

I agree, particularly with your final paragraph. We should think globally and use the 80/20 rule!

LikeLike

When alternative sources of energy do not require any sort of subsidy by either Government or industry, they can be described as ‘mature’ forms of energy and can be profitable without that economic intervention. When that happens, by ALL MEANS, lets introduce it to the marketplace. Until then, coal, oil and natural gas will rule the day. Anybody that believes subsidizing the many forms of alternative energy is living in an ‘alternative universe’. Any alternative source of energy must be profitable on it’s own merits to be taken seriously. And only a profit-motive will achieve this goal.

LikeLike

Agree. We are in such dangerous waters by trying to kill of fossil fuels before the world can get by without them. We are trading a theoretical risk of a changing climate decades down the road for an absolutely real and far more devastating one in a few years time.

LikeLike

[…] Anyone working in Canada’s petroleum sector, from production to transportation to final distribution, is at least tangentially aware of the scale of global demand for petroleum products (just as anyone living within sight of Vancouver’s growing coal export terminal is at least tangentially aware of the global demand for coal). But even with that knowledge advantage, it is hard to appreciate how much energy is required to put it all together. Read on… […]

LikeLike

[…] Public Energy Number One: India’s infrastructure requirements – an eye-opening reminder of the world’s staggering demand… […]

LikeLike

[…] Public Energy Number One: India’s infrastructure requirements – an eye-opening reminder of the world’s staggering demand… […]

LikeLike